This post was originally published on this site

Morgan Stanley has flagged 29 Chinese stocks that are most likely to benefit from the completion of a phase one deal between the U.S. and China.

Nearly half of them are from the information technology sector, which has been hit by the trade war as those companies have been on tariff lists. Eight are from the consumer sector.

“These two sectors saw the biggest scale of valuation re-rating based on their previous reaction to de-escalation events,” Morgan Stanley said in a report last week.

All 29 have sizable exposure to U.S. revenues — more than 25%, the investment bank said.

Trade optimism boosted sentiment as U.S. President Donald Trump on Friday said he had “a very good talk” with China’s leader Xi Jinping about the so-called phase one trade deal they struck in mid-December. That indicated more progress has been made after they reached the initial agreement.

The president said in a tweet that China has started “large scale” purchases of U.S. agricultural products, and a formal deal signing is being arranged. On Saturday, he said both countries would “very shortly” sign the deal.

“We believe IT/Internet-related and Transportation stocks will benefit the most from any de-escalation of trade tensions – IT and Internet due to their exposure to tariff impacts and technology bans, while Transportation stocks, especially Airlines, should benefit from an improved global trade outlook and strengthened CNY/USD,” the bank wrote.

The stocks include:

- Laptop maker Lenovo, with 31% exposure to U.S. revenues.

- Foxconn Industrial Internet, with 30% exposure.

- Apple supplier AAC Technologies, with 58% exposure.

- World’s largest pork producer WH Group, with 57% exposure.

- Luggage manufacturer Samsonite, with 37% exposure.

The rest are: Nexteer Automotive Group, Ningbo Joyson Electronic, Zhongji Innolight, Sunwoda Electronic, Regina Miracle International, Crystal International Group, Alpha Group, Goodbaby International, Bestway Global Holding, Jiangsu Yangnong Chemical, Shandong Nanshan Aluminium, WuXi AppTec, WuXi Biologics Cayman, GigaDevice Semiconductor Beijing, SMIC, Jiangsu Changjiang Electronics Tech, Luxshare Precision Industry, GoerTek, Lens Technology, Shenzhen Sunway Communication, FIT Hon Teng, Universal Scientific, Legends Holdings, Cosco Shipping.

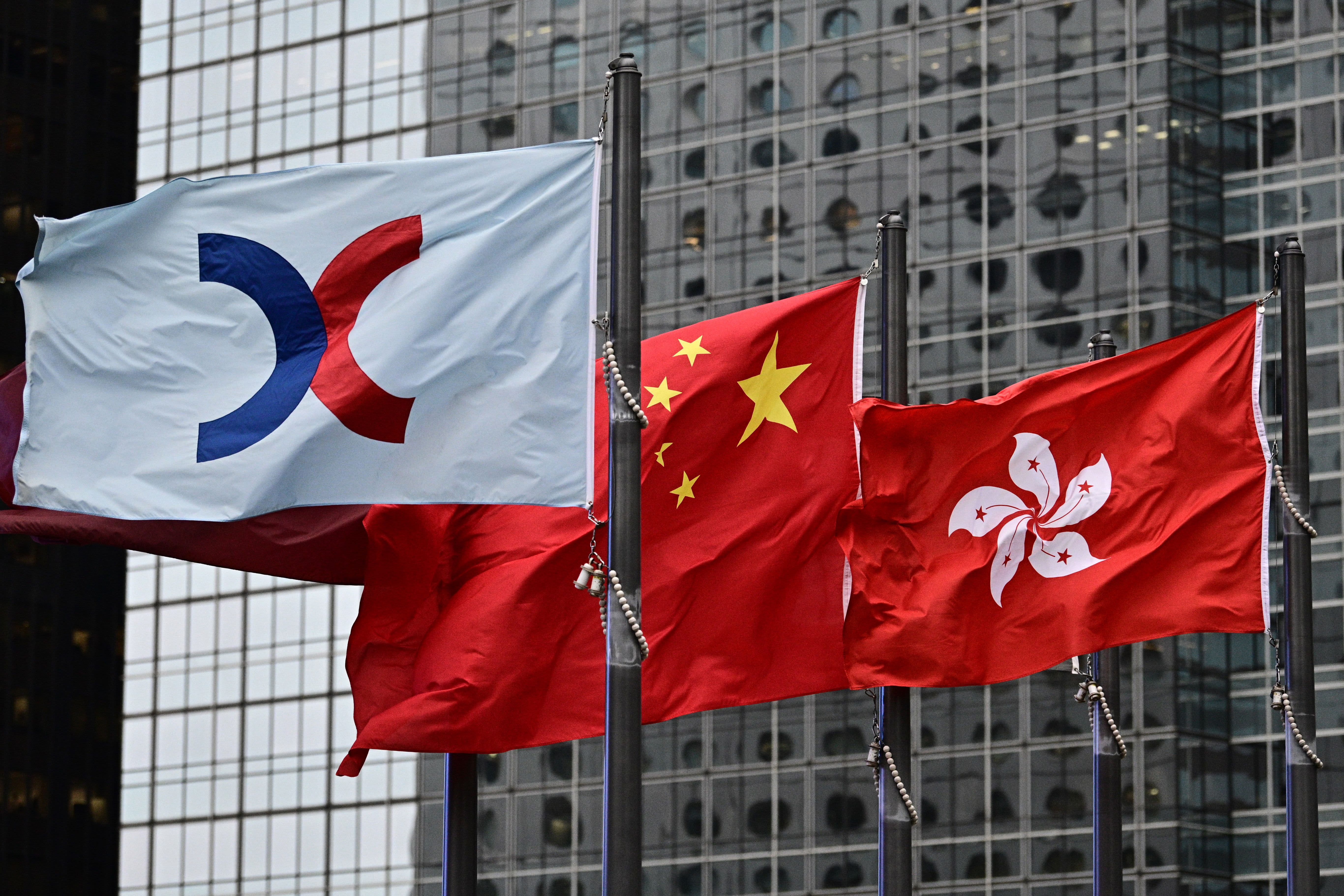

They are all listed on either the Hong Kong, Shanghai or Shenzhen stock exchanges.

But the outlook of those sectors is contingent on the dynamics between the U.S. and China, Morgan Stanley said.

That includes the actual signing of a deal, it said, pointing out that both countries have been close to signing a deal several times in the past 18 months — to no avail.

The details of the execution also matter, the bank said. Some key issues include any actions on intellectual property protection by China – a key sticking point in negotiations, as well as any potential timeline for phase two negotiations.