This post was originally published on this site

CNBC’s Jim Cramer has taken note of President Donald Trump’s newfound optimism but remains skeptical of the odds that leaders of the U.S. and China will sign on a trade deal in the near future.

In keeping with the spirit of the time, however, the “Mad Money” host on Thursday revealed a basket of stocks that he thinks will be buoyed by the teased agreement.

“I still think the best way to bet on a trade deal is by presuming something’s going to go wrong, even after today’s encouraging developments,” he said, adding he would rather own “stocks that have nothing to do with the trade war, but I know people have been demanding this list.”

Earlier in the day, Trump tweeted that negotiators are close to making a “BIG DEAL” and that both sides wanted to land one. That comes after weeks of the president’s exclamations that China needs the trade war to end more than the U.S. does.

The Trump administration is said to have reached a long-discussed “phase one” deal that would throw out the next round of tariffs on about $160 billion in Chinese imports, set to go into effect on Sunday, and potentially reduce existing duties on $360 billion worth of items.

The major stock averages all surged more than 0.70% during the session, with the S&P 500 and Nasdaq Composite both making new closing highs of 3,168.57 and 8,717.32, respectively.

Cramer said there remains a chance that Chinese negotiators renege on an agreement but explained what the “phase one” deal would mean for the stock market.

“Just remember, please, these are mostly short-term trades, not investments,” he said.

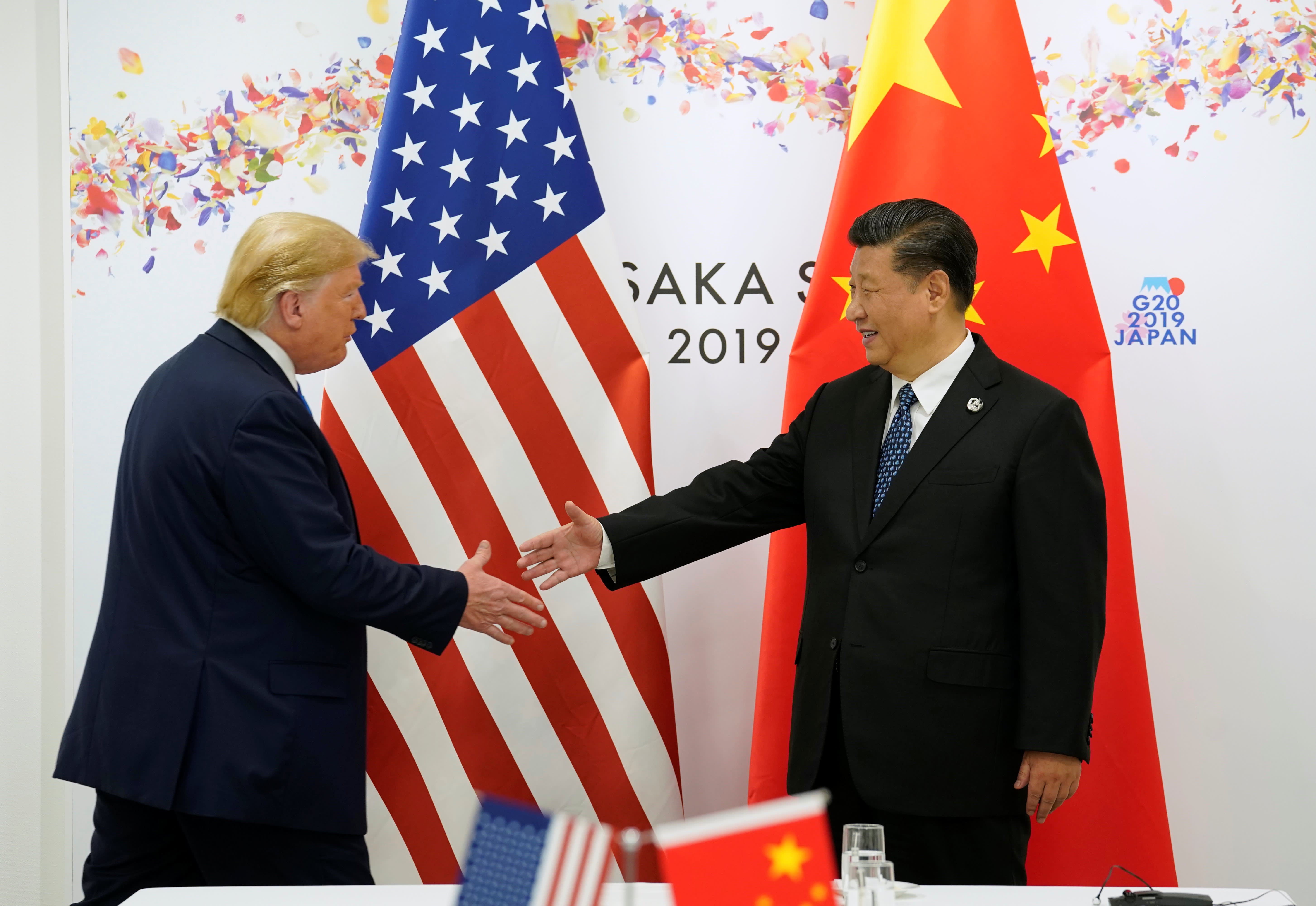

U.S. President Donald Trump and China’s President Xi Jinping shake hands before their bilateral meeting during the G-20 leaders summit in Osaka, Japan on June 29, 2019.

Kevin Lamarque | Reuters

Financials

The bank stocks have posted big gains, but Cramer believes they stand to gain more on a trade deal. J.P. Morgan Chase, Citigroup, Goldman Sachs, Bank of America, American Express, Mastercard and Visa all made his list.

“Again, though, all of these stocks are excellent; even if the deal somehow falls through [their] valuations are not that bad,” Cramer said. With the exception of Mastercard, “you can handle any deal that breaks down and still do OK.”

Technology

Apple, one of the biggest names caught in the trade dispute, could dodge an iPhone price increase if the new tariffs are called off. A major 5G play to own is Nvidia, as a trade deal would open the door for Chinese regulators to let the company acquire Mellanox, Cramer said.

Skyworks Solutions, Qorvo, Qualcomm and Marvell Technology are other stocks that can pop, he said.

Manufacturing

Caterpillar, Honeywell and Cummins shares “might go up if the trade war’s really ending, but I don’t want to go crazy for them,” Cramer said.

Toys

Shares of Hasbro and Mattel, makers of iconic toys that have been working to move factories out of China, jumped about 4.4% and 2.4% in Thursday’s session.

“We were very conscious that this weekend’s tariffs were going to hurt them inordinately,” Cramer said. “They’re really in the crossfire. Well guess what: If we do delay or scrap [Dec. 15 tariffs], these are going to be two stocks that you can still own and buy.”

Retail

Dollar Tree, Home Depot, Walmart and Target are on Cramer’s radar.

“The best thing about these retail stocks: There’s not a lot of upside built into them already, [which] makes them attractive,” he said.

Transports

FedEx shares rallied about 3.7% Thursday and have more room to run, the host said. As far as railroads, Union Pacific has the most exposure to China and has a lot to gain out of a trade deal, he added.

Disclosure: Cramer’s charitable trust owns shares of Home Depot, Apple, Honeywell, Mastercard, J.P. Morgan Chase, Citigroup, Goldman Sachs, Marvell Technology and Nvidia.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com