This post was originally published on this site

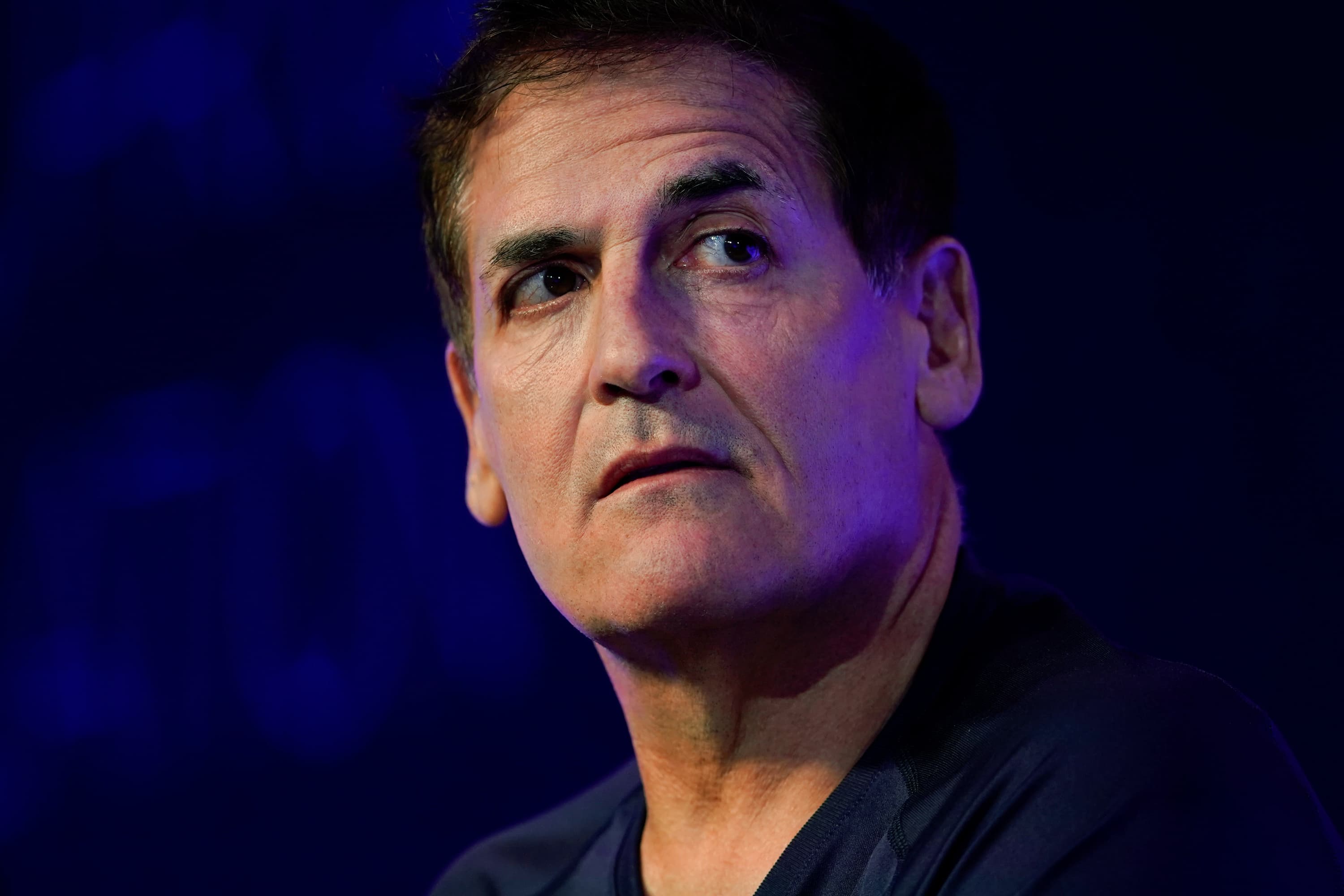

Mark Cuban, entrepreneur and owner of the Dallas Mavericks, speaks at the WSJTECH live conference in Laguna Beach, California, October 21, 2019.

Mike Blake | Reuters

Billionaire entrepreneur Mark Cuban said Monday the recently launched small business loan program has been beset by challenges that could impact the long-term outlook for companies.

“Banks are playing themselves. They’re being banks and they’re trying to determine if the credits are good and that’s leading to a lot of small businesses that are left out in the cold,” Cuban said on “Squawk Box.” “We are at an inflection point” to get money into the system for businesses of all sizes.

Cuban, owner of the NBA’s Dallas Mavericks, said the companies he’s invested as part of “Shark Tank” have faced challenges in applying for the loans.

He’s been particularly outspoken during the coronavirus pandemic. He has put pressure on Washington lawmakers to prioritize workers in economic stimulus legislation. He’s argued any company that receives government aid in such legislation should be prevented from buying back its stock.

Cuban has also advised business leaders against sending their employees back into the office too soon, warning that doing so could “define their brand for decades.”

Last Wednesday, Cuban told CNBC he was surprised by the stock market’s rally, arguing it seemed like a situation of “buy the rumor and potentially we sell the news when reality sets in.”

Cuban, whose core personal stock holdings are in Amazon and Netflix, said last week that he hadn’t bought stocks in two weeks and was “trying to get more cash.”

The Dow Jones Industrial Average gained 12.7% last week, while the S&P 500 rose 12.1% in its best week since 1974. The Dow and S&P 500 are now less than 20% off their February record highs.

— Disclosure: CNBC owns the exclusive off-network cable rights to “Shark Tank,” on which Mark Cuban is a co-host.