This post was originally published on this site

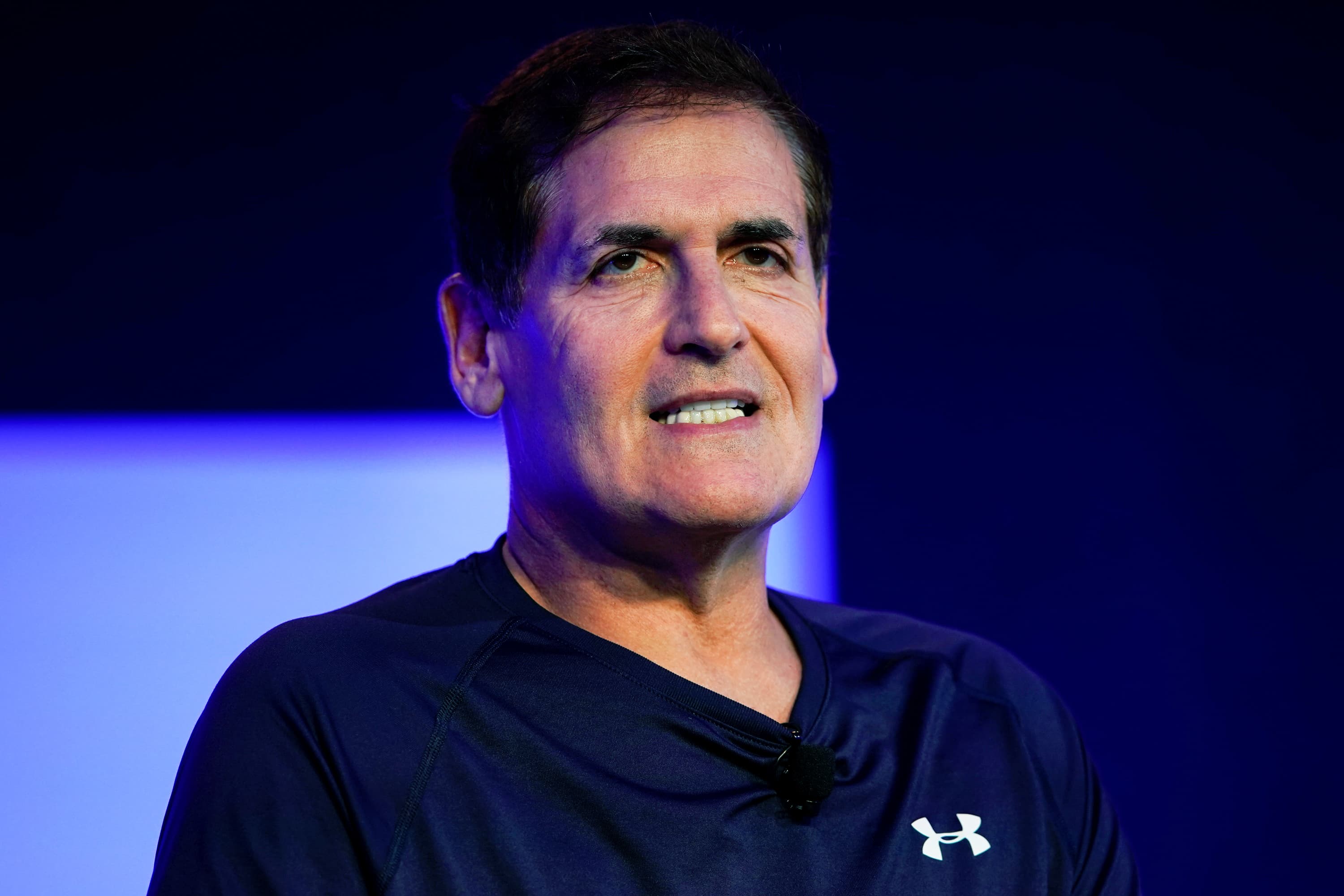

Billionaire entrepreneur Mark Cuban told CNBC on Thursday he was worried about valuations across a range of asset classes and has adjusted his investment portfolio accordingly.

“I hedged the heck out of my portfolio,” Cuban said on “Squawk Box.” He said near-zero interest rates from the Federal Reserve have helped lead to “speculation” across various areas, “whether it’s cryptocurrency, whether it’s trading cards, whether it’s non-fungible tokens.”

“When you have such low interest rates, you’re going to get appreciable assets inflating,” said Cuban, who owns the NBA’s Dallas Mavericks and “Shark Tank” investor. “It creates a lot of concern because when interest rates, if and when they go up, and who knows whether it’s years or decades when we’ll see 4%, 5% interest rate again, then people will have different decision criteria.”

Cuban, who made billions of dollars during the dot-com boom, said he was hesitant to describe the current situation in financial markets as “a bubble because it’s reality given the interest rates.”

“But there will be a deflation of some sort in those appreciable assets and it’s going to be scary when that happens,” said Cuban, who sold Broadcast.com to Yahoo in April 1999 for $5.7 billion.

Disclosure: CNBC owns the exclusive off-network cable rights to “Shark Tank,” on which Mark Cuban is a co-host.