This post was originally published on this site

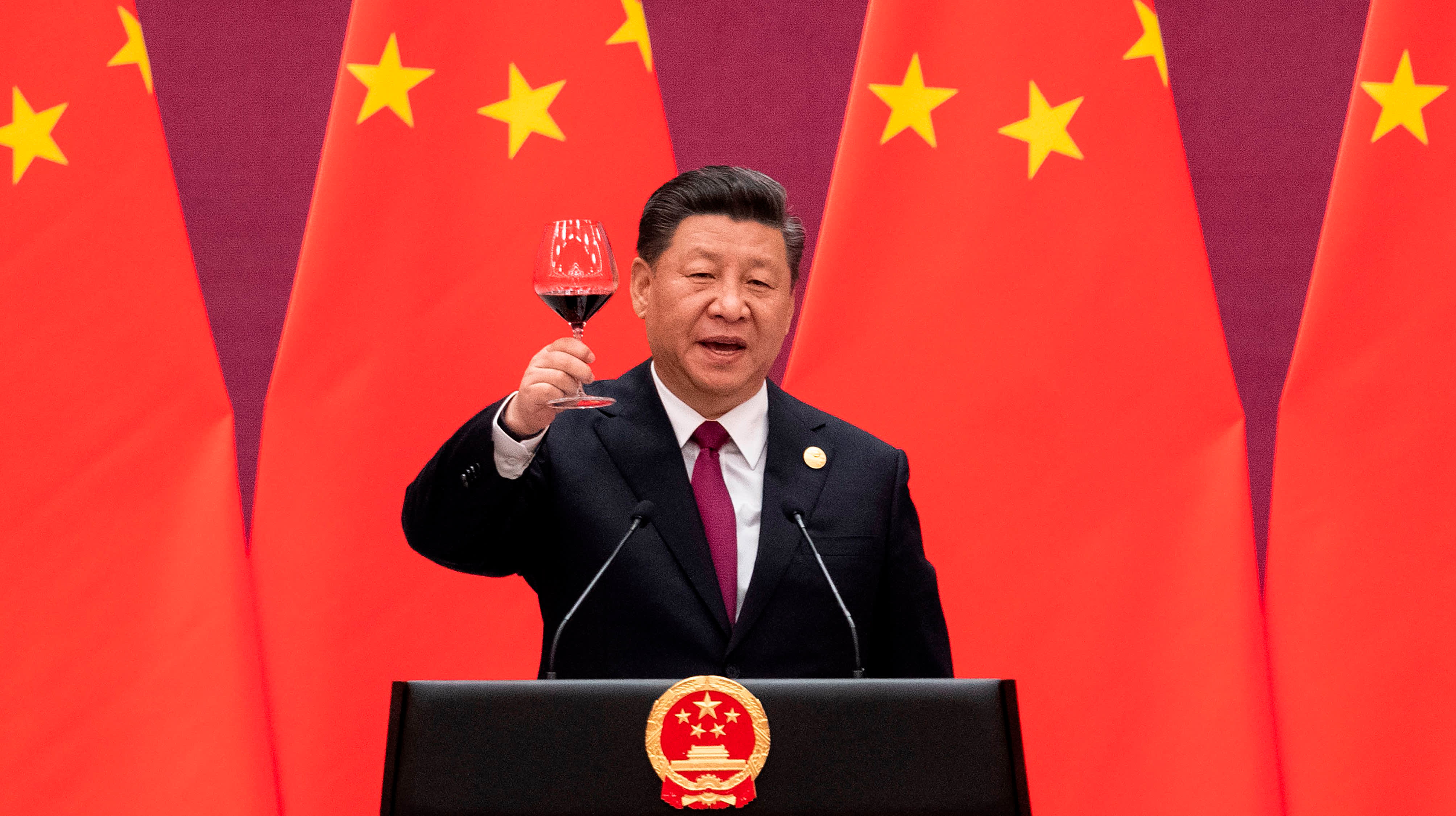

China’s President Xi Jinping raises his glass and proposes a toast at the end of his speech during the welcome banquet for leaders attending the Belt and Road Forum at the Great Hall of the People in Beijing on April 26, 2019.

Nicholas Asfouri | AFP | Getty Images

Morgan Stanley forecasts that global growth will recover from the first quarter of 2020 onward as trade tensions and monetary police ease, reversing the downward trend of the past seven quarters.

“Easing trade tensions (the key factor in the global downturn) will reduce business uncertainty and make policy stimulus more effective,” the bank’s analysts said in its global outlook for 2020. The firm projects global economic growth of 3.2% next year, compared to 3% in 2019.

Much depends, however, on the outcome of U.S.-China trade talks and whether or not the Trump administration’s next round of tariffs, scheduled for Dec. 15, go into effect. If those tariffs are activated, global growth in the final quarter of this year will slow to 2.8% and a recovery will be delayed until the third quarter of 2020, according to Morgan Stanley.

Optimism about U.S.-China trade talks lifted the Dow Jones Industrial Average to a record on Friday after White House Economic advisor Larry Kudlow said the two sides were close to a deal. Chinese state media said Saturday that the U.S. and China held “constructive discussions” on a phase-one deal over the weekend.

However, the idea of easing off on tariffs has divided the White House, and Trump has said publicly that he has not committed to lifting any of his administration’s duties against Chinese exports. Beijing is also reportedly reluctant to commit to purchasing $50 billion in U.S. agriculture goods, a key demand from Trump.

Still, trade tensions and monetary policy are easing in tandem for the first time in seven quarters, with 20 out of 32 central banks that Morgan Stanley tracks slashing interest rates with more easing on the horizon.

“We expect more easing, with the global weighted average policy rate touching a seven-year low by March 2020,” Morgan Stanley’s analysts wrote.

The U.S., however, will experience slower growth as emerging markets drive much of the recovery. Morgan Stanley forecasts that real GDP growth in the U.S., which is “clearly in late-cycle,” will slow from 2.3% in 2019 to 1.8% in 2020.

The Federal Reserve’s decision to slash rates by 75 basis points this year lifted private demand, driving housing and consumer durables and offsetting weakness in sectors exposed to the world and the trade war, according to the bank. This help stabilized the slowdown, but much of the benefit has already been absorbed.

“In 2020 the economy grows more slowly as the bulk of the positive lift from lower interest rates will have been absorbed and households balance higher income with higher prices from tariffs.” Morgan Stanley said. “But the economy is on solid footing,with less external drag, sustained easy monetary policy and continued support from fiscal policy.”

Fed Chair Jerome Powell, during testimony before Congress on Wednesday, said rates are unlikely to change anytime soon so long as the economy remains on its present path. Morgan Stanley expects the Fed to hold rates steady in 2020, but forecasts two hikes in the second half of 2021 once inflation hits 2.5%.

Though the U.S. economy is on a solid footing, the bank still sees uncertainty surrounding trade policy as a key downside risk as well as the looming 2020 presidential election.

“Moreover, uncertainty about economic policy, particularly if we see a close presidential race, may weigh on business and household decisions in 2020,” Morgan Stanley said.