This post was originally published on this site

People pass a sign for JPMorgan Chase at it’s headquarters in Manhattan, New York City.

Spencer Platt | Getty Images

Federal prosecutors have asked for two civil cases against J.P. Morgan Chase be put on hold until they have finished a related criminal prosecution involving current and former precious metals traders at the nation’s largest bank.

The Justice Department has asked for the stay on civil proceedings to be extended on both civil cases pending in federal court in New York City through the conclusion of a related ongoing criminal case into precious metals activity at J.P. Morgan Chase.

That case was revealed in September when a 14-count criminal indictment against three current or former J.P. Morgan employees, including the global head of base and precious metals trading, was unsealed. The indictment alleges the traders, along with eight unnamed co-conspirators who worked at J.P. Morgan’s offices in New York, London and Singapore, participated in a racketeering conspiracy in connection with a multiyear scheme to manipulate the precious metals markets and defraud customers.

At the arraignment last week in Chicago federal court, federal prosecutors disclosed that the investigation is still ongoing and said they intend to seek a superseding indictment adding at least one additional defendant within the next thirty days, according to a spokesman for the Justice Department.

According to court filings, attorneys for both civil lawsuits oppose the government’s motion to further extend the stay in their respective cases, while the defendant, J.P. Morgan, does not oppose it.

The first civil suit was filed in 2015 by hedge fund manager Daniel Shak and two commodity traders accusing J.P. Morgan of manipulating the silver futures market from 2010 through 2011, costing plaintiffs $30 million in losses.

In their request for the stay to be extended, prosecutors say that while the criminal case covers a broader range of conduct, events and time covered in the civil lawsuit, there is overlap with the case.

As part of the Justice Department’s argument for the stay to be extended prosecutors point to evidence prosecutors uncovered in their criminal investigation that pre-dates the current late 2010 to early 2011 period covered in the second amended complaint.

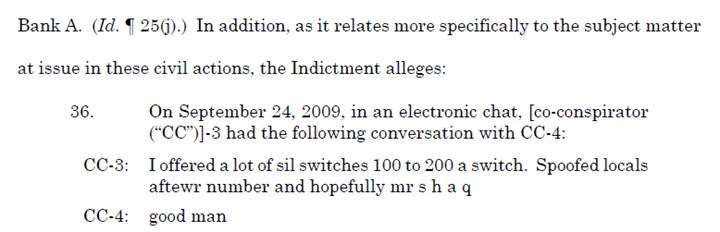

“The Indictment contains allegations regarding a September 24, 2009 communication between alleged co-conspirators that appears to relate to spoofing in connection [with] plaintiff Daniel Shak and other ‘locals’ on the trading floor,” prosecutors said in the court filing.

Proceedings for the case has been paused since November 30 after David Kovel, the plaintiffs’ attorney, sought permission to reopen questioning of two former J.P. Morgan traders, including John Edmonds, and the bank’s global head of base and precious metals trading, Michael Nowak.

Edmonds pleaded guilty to making bogus bids on precious metals contracts while working at J.P. Morgan from 2009 to 2015. While Nowak was one of the three individuals indicted in September.

The second civil suit the government seeks to pause until the criminal case has concluded, is a consolidated class action against J.P. Morgan and the firm’s precious metals traders who allegedly manipulated the prices of precious metals futures contracts from approximately Jan. 1, 2009 through Dec. 1, 2015.

Prior to the government’s request to extend the stay on the consolidated class action, Vincent Briganti, the interim lead class counsel, notified the court that plaintiffs intended to oppose the motion.