This post was originally published on this site

The adage “what goes up must come down” is playing out right now for some of the Street’s most popular speculative stocks.

Virgin Galactic, Tesla and Plug Power all plunged on Thursday — falling much more than the broader market — in a sharp departure from the stocks’ recent meteoric rises, which was driven at least in part by retail investors piling into these names.

Virgin Galactic slid 18%, while Tesla and Plug Power were each down 9%. Earlier in the session the drops had been steeper, but some of the losses were pared around midday as the broader market bounced back.

In the last week, Virgin Galactic is down 36%, while Tesla and Plug Power have each shed 21%.

Before this week’s slide, Virgin Galactic posted weekly gains of 18.10%, 51.51% and 10.38% in the last three weeks. Tesla is coming off 12 straight positive weeks, and for the week ending Feb. 21 Plug Power rose 26%.

As these stocks jumped double digits in single sessions, retail investors were among those getting in on the trade, with users flocking to social media sites like Reddit to tout the companies. Data from trading platforms SoFi, Fidelity and TD Ameritrade reported spikes in trading volumes.

There are certain similarities between the three companies, perhaps the most obvious of which is that each one is a bet on future technologies taking hold, which means that investors are willing to pay a premium now for what they believe will be future growth.

Tesla is focused on electric vehicles and battery technologies, as well as the future of energy, while Virgin Galactic is developing a space tourism business that also hopes to develop hypersonic long-distance travel capabilities. Plug power makes environmentally friendly hydrogen fuel cell systems that are manufactured to power warehouse machines like forklifts.

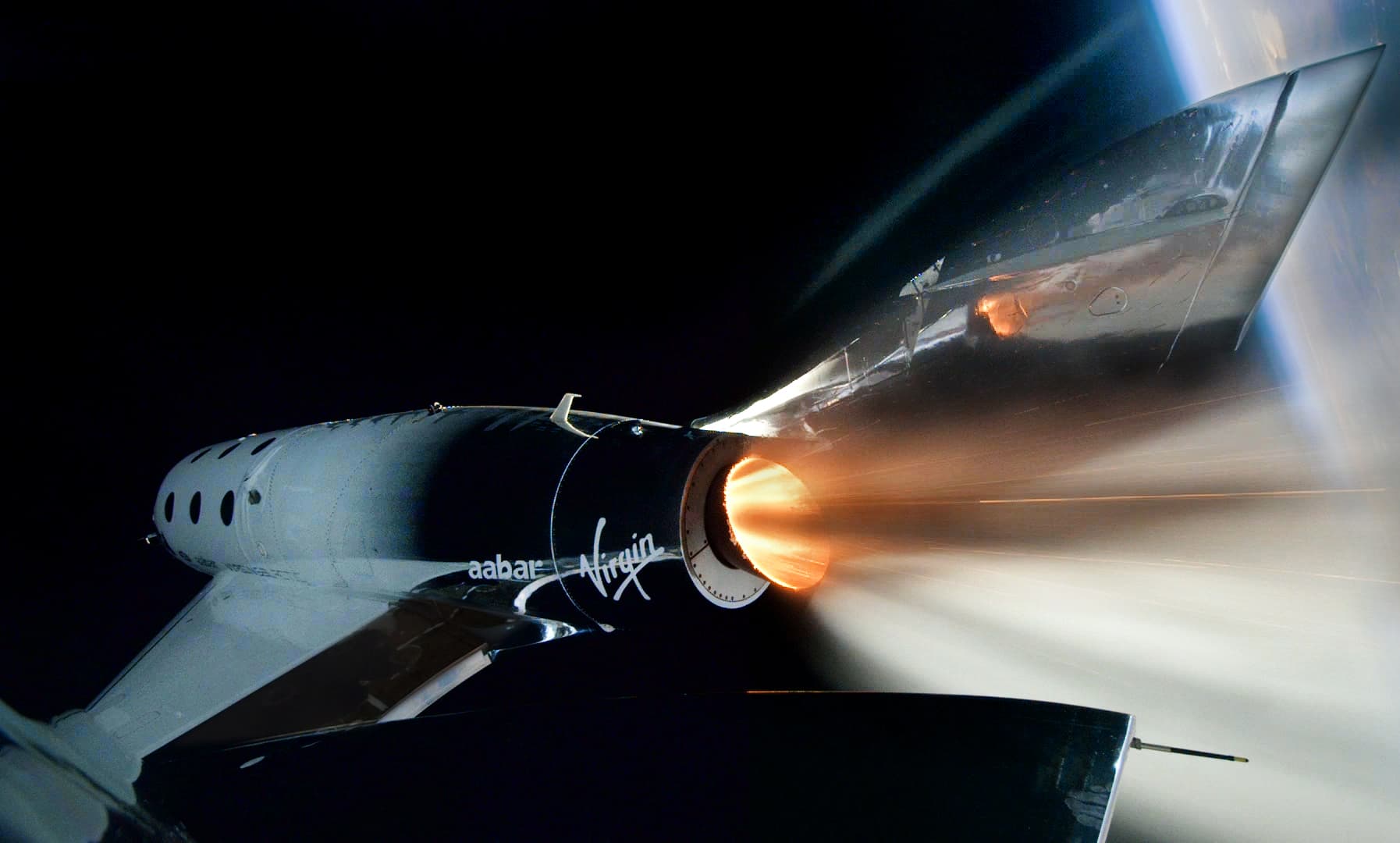

Virgin Galactic’s spacecraft Unity reaches space for the first time.

Source: Virgin Galactic

Part of Virgin Galactic’s acceleration of losses on Thursday — the stock finished Wednesday’s session with a decline of 15.5% — was due to two downgrades on the Street.

Morgan Stanley’s Adam Jonas cut the stock to equal-weight from overweight in a note titled “waiting for the fundamentals to catch up,” while Credit Suisse lowered the stock to neutral from outperform saying “we find ourselves no longer able to recommend SPCE shares.” The downgrades came after the company reported a greater-than-expected loss for the fourth quarter Tuesday after the market closed.

But even with Thursday’s steep drop, shares of Virgin Galactic are still up 98% for the year, and 212% in the last three months. In the last year, it has doubled in value, as have shares of Tesla and Plug Power.

This phenomenon of speculative stocks rising sharply is a characteristic of “late cycle” mentality, Bleakley Advisory Group chief investment officer Peter Boockvar said.

“In the history of the stock market there are always names that pop up and are the poster boys for speculation — companies that could cure cancer, take us to the Moon or Mars,” Boockvar told CNBC. “For the broader market it’s reflective of risk appetite and people willing to roll the dice.”

“In a world right now where there is slowing growth, there is a search on for anything growth related … and what’s cooler than electric vehicles and space?” he added.

– CNBC’s Michael Sheetz and Kate Rooney contributed reporting.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.