This post was originally published on this site

The S&P 500 hit a new record high on Monday, as strong performances by technology and bank stocks have sent the index climbing this month.

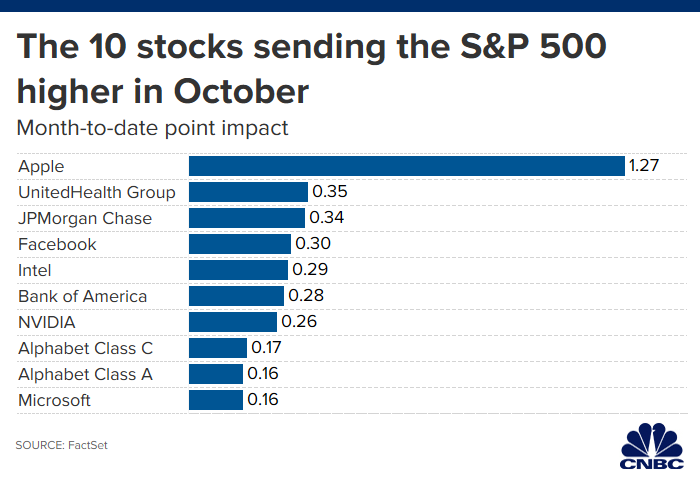

Heavily-weighted Apple has been the biggest contributor to the S&P 500 in October by a long shot, as shares of Apple are up 10.1% this month, contributing 1.27 points alone to the S&P 500’s October gain because of its large size. The S&P 500 is up more than 2%, or more than 45 points, this month to 3022.55 through Friday.

UnitedHealth and J.P. Morgan Chase were the second and third biggest contributors on the index for the month, climbing 13.8% and 7.1% respectively.

October’s top 10 contributors to the S&P 500 are largely rounded out by other tech companies and banks: Facebook, Intel, Bank of America, Nvidia, Google-parent Alphabet, Microsoft and Biogen.

Bank stocks have benefited from a recent rebound in bond yields, while many of the technology stocks have gotten relief from optimism about trade negotiations in China. Companies like Apple and Nvidia have significant exposure to the trade war with China through supply chains and sales. Investors are also growing optimistic about Apple’s iPhone sales. Apple reports earnings on Wednesday.

Stocks hitting all-time highs

J.P. Morgan shares hit an all-time high on Friday, leading a pack of stocks setting records at the end of last week. Bank of America’s stock hit its highest level since October 2018, while Western Union shares rose to levels not seen since September 2008.

Charter Communications, O’Reilly Auto, Illinois Tool Works and Sherwin Williams are a few other stocks that reached all-time highs on Friday. Both Phillips 66 and Valero traded at levels not seen since October last year.