This post was originally published on this site

PayPal will not layoff any employees due to the coronavirus pandemic, CEO Dan Schulman said Tuesday, making the digital payments provider the latest company to make such a pledge.

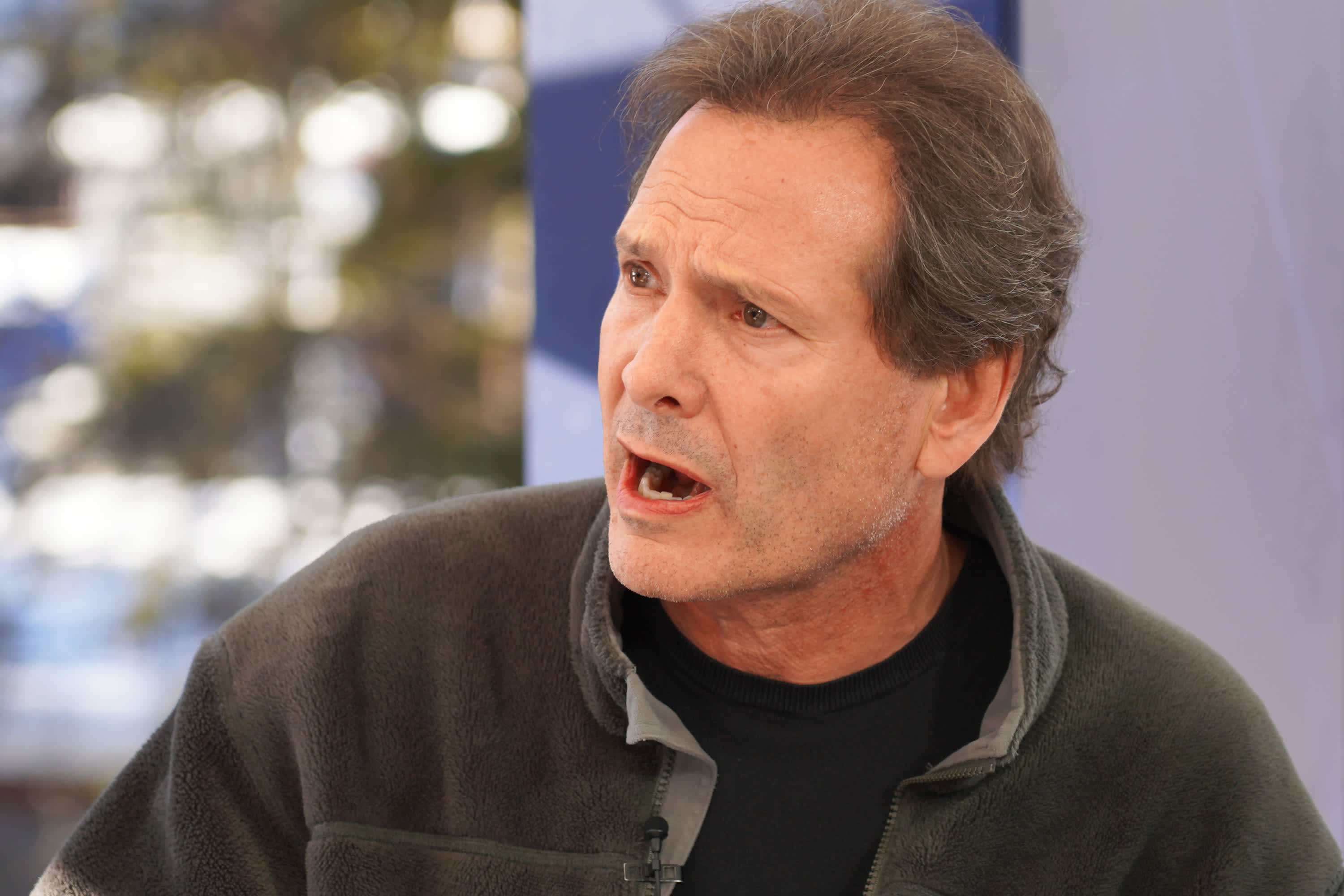

“We don’t intend to do any layoffs as a result of COVID-19,” Schulman said on CNBC’s “Squawk on the Street.” “This is the right thing to step up, to make sure they know that we’ve got their back.”

“If they’re sick, we pay them. If an office closes, we pay them,” he added. “We really need to be sure that we have their health and their finances at heart as we deal with this crisis right now.”

Later on Tuesday, Marvell Technology CEO Matt Murphy also told CNBC the semiconductor provider has “no plans” to layoff employees because of the global pandemic.

“I want the team to be totally focused on the mission at hand,” which includes taking care of customers and their own families, Murphy said on “Squawk Alley.”

PayPal and Marvell join the likes of Bank of America, Morgan Stanley and Starbucks, which have also offered job-safety assurances to employees who are worried about the economic shock from the coronavirus.

“We don’t want our teammates to worry about their jobs during a time like this,” BofA CEO Brian Moynihan told CNBC on Friday. “We told them all, there’s no issue, you’re all going to be working now through year-end. No layoffs, no nothing.”

Morgan Stanley CEO James Gorman last week told his employees in a staff memo that the company it will not reduce its workforce for coronavirus reasons through 2020.

Earlier this month, Starbucks CEO Kevin Johnson told CNBC that the coffee giant will continue paying its employees for the next 30 days as “stay-at-home” orders impact its operations.

PayPal offers small businesses “flexibility to deal with the issues they have right now”

In addition to its no-layoff pledge, PayPal has taken steps to assist its business customers who are struggling with the economy coming to a near halt, Schulman said.

PayPal is allowing its business customers to push back repayments on business loans or cash advances at no additional cost. It also is doubling the window in which merchants can respond to a customer dispute and waiving fees for instant withdraws from business accounts.

“We’re basically trying to give small businesses the flexibility to deal with the issues they have right now,” Schulman said. “We’re one of the largest providers of working capital to small businesses, and we’re going to continue to provide that where we can.”

Schulman said “companies that have a degree of financial strength” need to help both employees and customers during the COVID-19 pandemic.

“We need to obviously take care of our shareholders, but I think the way we do that best is by taking care of our employees, taking care of our customers and stepping up and doing the right thing,” he said. “That’s, I think, at least how we build businesses that are enduring and an economy that can be strong. And a strong economy is helpful for everybody.”