This post was originally published on this site

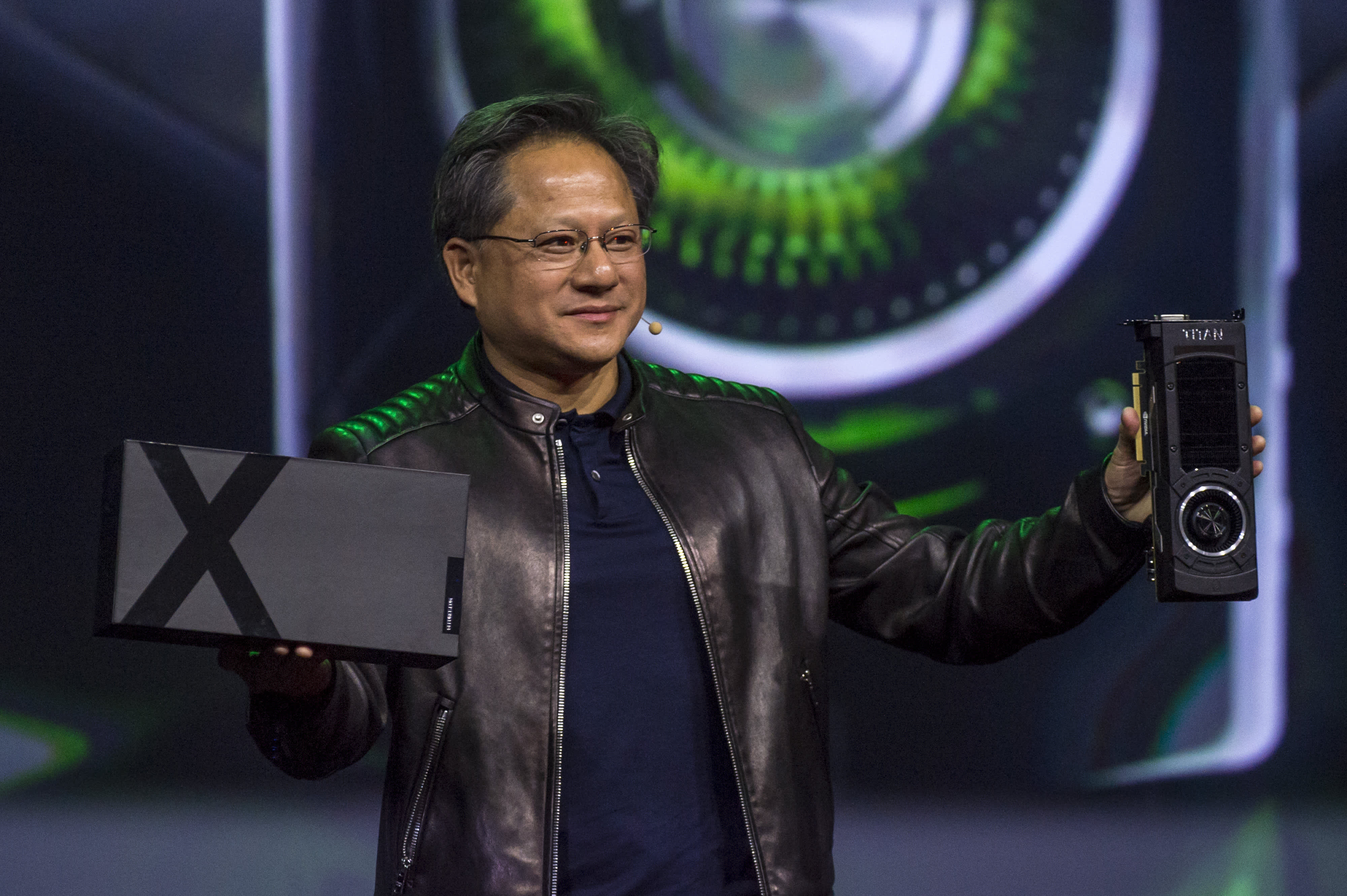

Jen-Hsun Huang, chief executive officer of Nvidia Corp., holds up a Titan C CPU and GeForce GTX Titan X graphics card .

David Paul Morris | Bloomberg | Getty Images

Stocks have delivered very impressive gains recently. Indeed, indexes are circling record levels, boosted by strong second quarter earning reports and reopening optimism. That’s despite economic decline and rising jobless claims as the fallout from the coronavirus pandemic continues.

For investors, the key is to focus on stocks that are set to deliver strong growth in expanding markets. Here we look at six stocks that do just that- and what’s more, all these stocks have received bullish calls from the Street’s top analysts over the last week.

TipRanks analyst forecasting service attempts to pinpoint Wall Street’s best-performing analysts- so investors can follow the recommendations of analysts that tend to get it right. These are the analysts with the highest success rate and average return measured on a one-year basis — factoring in the number of ratings made by each analyst.

Here are the best-performing analysts’ six favorite stocks right now:

Amazon

Five-star Needham analyst Laura Martin has just reiterated her Amazon buy rating with a bullish stock price forecast of $3,700. She made the move after taking a deep dive into the company’s Amazon Prime and Prime Video services.

“We calculate that Amazon Prime is worth nearly $200B, or 12% of AMZN total EV. Stand alone, we calculate that Prime Video is worth nearly $40B, or about 2% of AMZN’s total EV, based on NFLX current per sub valuations” the analyst told investors on August 17.

Martin highlights more than a dozen independent data providers’ May, June and July data points that demonstrate accelerating consumer adoption of streaming services- like Amazon’s Prime Video.

Indeed, coronavirus shelter-at-home orders, shuttered cinemas, no live sports, and negative topics dominating the news cycle have all boosted streaming demand, says the analyst.

And unlike Netflix, Prime Video benefits from its tie-in with other Prime services- bringing new subscribers and lowering churn. The analyst cites a Diffusion group survey which found that 80% of subscribers pay for Prime primarily for free shipping, while the remaining 20% pay primarily for its media assets.

According to TipRanks, Martin is ranked at an impressive #94 out of almost 6,900 analysts, with a 20.1% average return per rating.

Regeneron

Regeneron is currently developing a promising antibody cocktail against coronavirus. REGN-COV2 could help treat people already experiencing coronavirus symptoms- and prevent infection in people exposed to the virus.

“We are excited about the potential for one medicine to serve both as a treatment for those infected as well as protection for people exposed to the virus. REGN-COV2 could be a critical line of defense against the COVID-19 pandemic,” Bill Anderson, CEO of Roche stated on August 19.

Following a call with Regeneron management, top Oppenheimer analyst Hartaj Singh reiterated his buy REGN buy rating with a $725 price target. “We stay bullish and view REGN as a core holding” the analyst wrote.

He notes that REGN is running the REGN-COV2 trials in a full spectrum of patients (preventative, hospitalized, etc.), testing various doses, and working with other firms to scale manufacturing and working on future accounting treatment, pricing, and distribution.

Regeneron’s pipeline is also progressing well, says Singh, with Dupixent in chronic obstructive pulmonary disease (COPD) and oncology among the standouts. “REGN is on the cusp of strong 20/21 sales growth,” Singh told investors on August 17.

Nvidia

Bank of American analyst Vivek Arya has just reiterated his ‘Top Pick’ status on chip stock Nvidia following stellar earning results. He also ramped up his stock price forecast from $520 to a Street-high $600 (24% upside potential).

“Solid beat/raise, with ~30% YoY sales, ~50% YoY pf-EPS organic growth and importantly, 38% FCF margins that are best-in-class in not just large-cap semis but also likely in all-tech” cheered the analyst on August 19.

Meanwhile, NVDA’s developer base crossed 2 million, with the second million coming in just the last two years, 5x faster than the first.

Looking forward, Arya sees continued secular momentum with new product cycles (next gen 7nm Ampere launch) and recovery in cyclical autos offsetting a potentially ‘lumpy’ data center business.

“Bigger picture, we believe NVDA has an unassailable hardware / software / developer lead in some of the largest and fastest growing markets in semis/tech (AI, Gaming, Autonomous), all derived from a common architecture” the analyst tells investors.

He believes this can potentially drive sales at 20% and EPS at a 25% pace to head towards $22/ share by CY24E. According to Arya, this now paints a scenario for the world’s first $0.5 trillion market cap chip vendor.

Thanks to his strong stock picking skills, Arya is ranked at #117 out of 6,895 analysts tracked by TipRanks.

2U

2U Inc specializes in digital education, including supplying colleges and universities with a cloud-based software-as-a-service platform, coursework design and infrastructure support.

And the stock has just received the thumbs up from top Needham analyst Ryan MacDonald. This five-star analyst reiterated his TWOU buy rating with a $50 price target on August 17. Despite shares already surging 64% year-to-date, his stock price forecast indicates further upside potential of 27%.

“We remain bullish on 2U‘s growth prospects as the company continues to find creative ways to drive an accelerated adoption of online education” the analyst told investors.

TWOU’s most recent partnership offers a credit-bearing “Semester of Code” program for Arcadia University. Not only does Arcadia boast 2,400 undergrad students, but the university’s study abroad program hosts nearly 3,000 students from 300 university partners annually.

“We view this new partnership as a creative and accretive way to further penetrate the sizable undergrad opportunity” MacDonald writes.

Investors are currently underappreciating the ongoing shift to online education, and 2U’s progress towards limiting cash burn says the analyst. With a 20% EBITDA margin achievable longer term, he believes “the discounted valuation creates an attractive entry point.”

Lowe’s

“One for the record books” cheered five-star Wells Fargo analyst Zachary Fadem after Lowe’s blowout second quarter. The analyst reiterated his buy rating on the home-improvement retailer on August 19, while boosting his price target from $180 to $185.

For a company of LOW‘s size, a 35% comp and 312bps of EBIT margin expansion is rare and historic, wrote the analyst, highlighting the extremely impressive 135% online growth for Lowes.com.

According to Fadem, LOW’s better-than-expected Q2 results “serve as further evidence that execution has clearly improved (after years of mismanagement), the category remains very strong (20%+ through Aug), and near-term benefits likely prove both cyclical and structural.”

And while tailwinds and government stimulus inevitably ease, he still sees plenty of long-term levers (Pro loyalty, Tool rental, Omni-channel, etc.) to drive sustainable comp growth and margin improvement that should ultimately exceed LOW’s ~12% mid-term target.

Despite all these tailwinds and associated fundamental improvements, LOW shares remain undervalued vs. rival Home Depot and a -10% discount vs. the S&P 500. “In our view, this isn’t the LOW of old, and it’s about time valuation caught up” Fadem concludes.

With a 30.6% average return, this is one of the Top 30 analysts on TipRanks.

Analog Devices

Analog Devices is a leading supplier of high-performance analog (HPA), mixed signal, and digital signal processing (DSP) ICs. And the stock has just received a seal of approval from Oppenheimer’s Rick Schafer. This is one of the best tech analysts on TipRanks, coming in at #30 out of 6,895 tracked analysts.

After ADI reported upside to earnings, Schafer told investors “ADI is our top large-cap 5G RAN play.” He reiterated his buy rating on August 19 with a $140 stock price forecast (18% upside potential).

Crucially, Analog is currently in the process of acquiring Maxim Integrated, in an all-stock transaction for ~$19 billion. ADI sees $275 million in MXIM cost synergies and an additional $100 million from LLTC synergies.

According to Schafer, ADI and MXIM have highly diversified, differentiated, and sticky high-performance analog (HPA) businesses with a focus on the high-margin industrial, automotive, and communications markets.

Looking ahead, he likes ADI’s 5G-led structural growth/margin profile and see the strategic MXIM deal affording the company scale to better compete against rival Texas Instruments.

“We believe ADI has one of the most attractive core business models in analog semiconductors, which looks even better when adding MXIM to the mix… We remain long-term buyers” the analyst wrote on August 19.