This post was originally published on this site

Jeff Bezos CEO of Amazon.

Joe Klamar | AFP | Getty Images

(This story is part of the Weekend Brief edition of the Evening Brief newsletter. To sign up for CNBC’s Evening Brief, click here.)

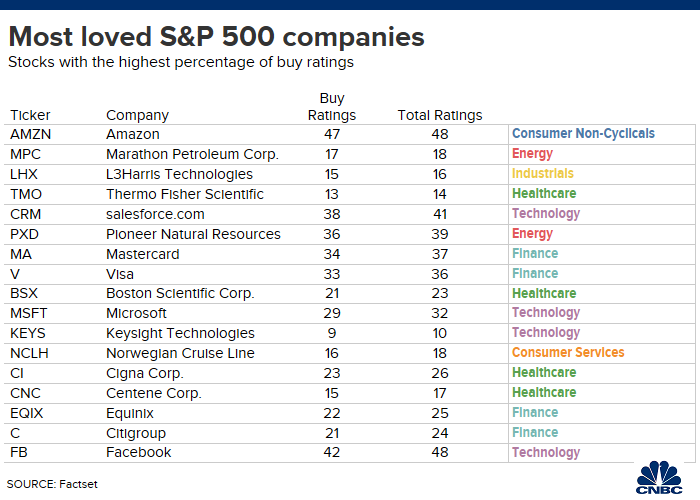

The Dow, S&P 500 and Nasdaq all hit all time record-highs this week and if investors are looking at what to own from here, the following stocks are the consensus favorites on Wall Street.

E-commerce giant Amazon is the most loved stock on Wall Street based on highest percentage of buy ratings. All but one of the 48 analysts covering the stock recommending buying into the Jeff Bezos-led company.

CNBC used FactSet to screen all S&P 500 companies looking for the stocks with the highest percentage of buy ratings compared with total ratings. We threw out companies that had less than 10 analysts covering them. Buy ratings, in this case, include overweight ratings.

It may not come as a shock that Amazon, the fourth-most valuable company in the world, is the most highly recommended stock on the Street. Over 50% of U.S. households have an Amazon Prime membership, according to UBS. The adoption of 1-Day shipping and international prime membership has helped boost the stock that is already up more than 1300% in the past decade.

Amazon’s 1-Day shipping “raises the bar in e- commerce yet again & accelerates the top line,” said J.P. Morgan analyst Doug Anmuth in a note to clients.

Amazon plays a large roll in the success of many other, smaller companies as well. Cosmetic company Coty surged 14% on Wednesday after reporting strong earnings, citing strong growth of its brand on Amazon.

Strong consumer boosts payment processors

Wall Street-adored stocks Visa and Mastercard are the world’s first and second largest payments processors, respectively. Visa, which has a market value of about $386 billion, and MasterCard, which has a market value of about $279 billion, have both ended the last eight years in positive territory, with most years accounting for double digit gains in the stocks.

This is despite newer payment players like PayPal, Apple Pay, Chime and Cash App entering the space.

“Visa has so far pursued an effective digital wallet strategy –countering some of the threats and actively taking advantage of the opportunities offered by these new entrants,” said MoffettNathanson analyst Lisa Ellis.

Some of the payment companies’ decade long success can be attributed to the health of the U.S. economy, currently in its longest expansion in history. A robust economy encourages customers to spend more, boosting fee income for MasterCard and and Visa. Visa is up nearly 35% this year and Mastercard has rallied more than 40% since January.

Equinix and Citigroup are the other two finance companies on the most-loved list.

Infallible Facebook

Facebook’s stock is up nearly 50% since January.

Most recently, Facebook was under fire for its decision to keep accepting political ads, after Twitter said it would stop running political ads. Facebook said its decision was consistent with its view on free speech.

“We remain optimistic on ongoing user and usage growth, which continues despite difficult press,” said Bank of American Merrill Lynch analyst Justin Post in a note to clients.

Technology is well represented with software companies salesforce and Microsoft, and electronics company Keysight Technologies all making the most-loved stocks list.

CNBC did the same screen back in June and UnitedHealth Group and Agilent Technologies fell off the top-rated list.

—with reporting from CNBC’s Michael Bloom.