This post was originally published on this site

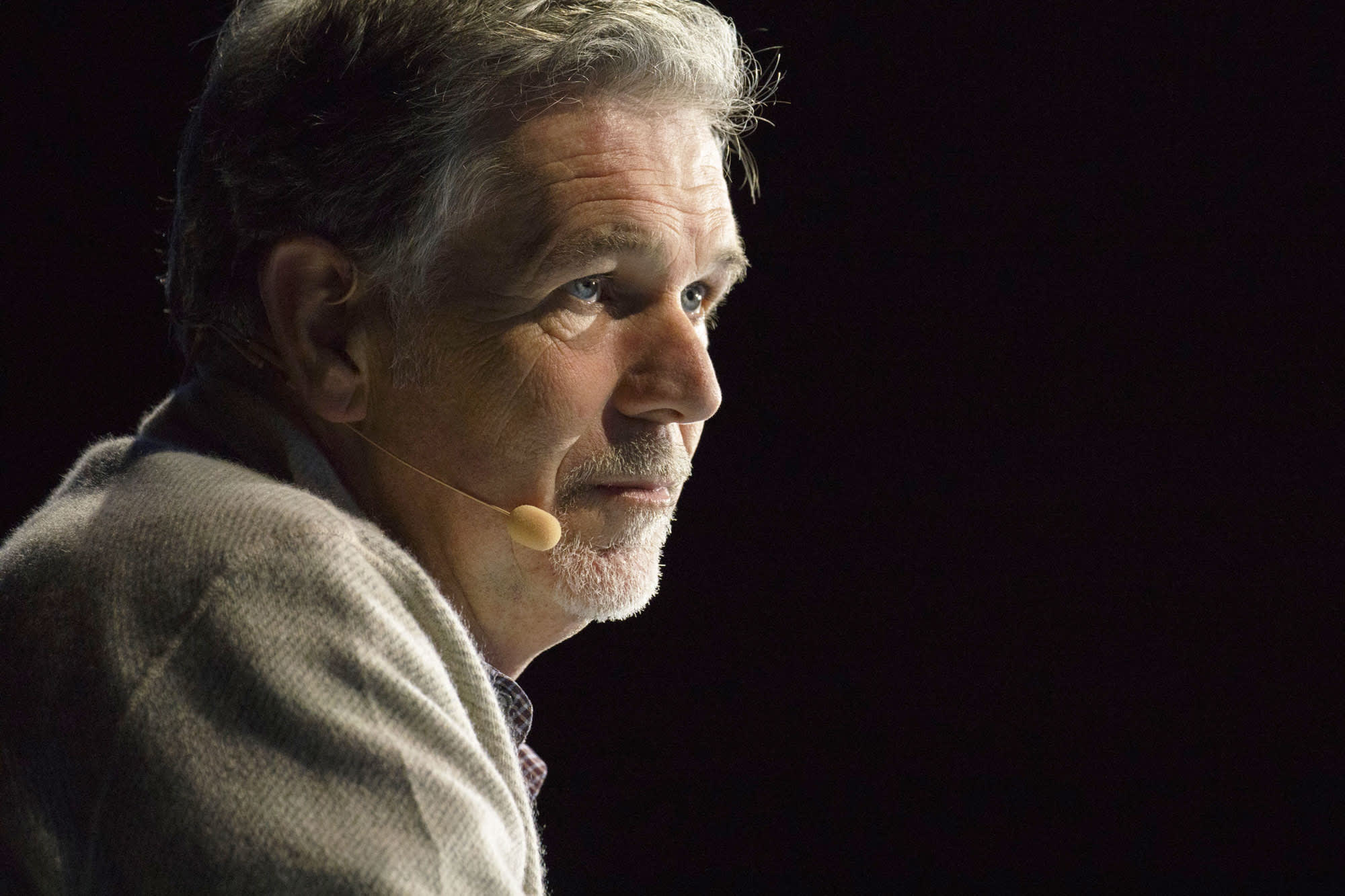

Reed Hastings, chief executive officer of Netflix

Patrick T. Fallon | Bloomberg | Getty Images

A small but significant group of Netflix and Disney+ users have told Bank of America they expect to cancel their Netflix subscriptions, rekindling concerns that new combatants in Wall Street’s “Streaming Wars” could hamstring current players.

The bank’s survey of over 1,000 Americans showed that 6.5% of respondents using both services said they plan to terminate their Netflix accounts.

Analysts Nat Schindler and Justin Post cautioned, however, that they have doubts as to whether the survey’s respondents will follow through on their plans.

“We are skeptical that much of this churn is incremental or will be realized, with Bloomberg reporting Netflix had seen no increase in cancellations on 11/22, 10 days after the Disney+ launch,” they wrote.

But “this level of churn, if realized, could be higher than expectations,” they wrote. In other words, if people actually cancel Netflix subscriptions as fast as the BofA survey suggests, brokerages across Wall Street would have to readjust their revenue forecasts.

To be sure, Bank of America remains positive on Netflix as a whole and recommends investors buy the stock. If the stock performs as well as analysts Post and Schindler predict over the next 12 months, stakeholders will be up 35%, a healthy return for any stock trader and ahead of the S&P 500’s 2019 gain of 27%.

In fact, Bank of America found that, compared to its prior survey, overall cancellation intentions for Netflix fell slightly to 4% from 5%. Sixty-five percent of respondents said Disney+ was not a good substitute for Netflix, while 33% said it was.

“Our survey and company reports suggest healthy U.S. adoption of Disney+, but we are encouraged that most early Disney+ users do not see it as a substitute for Netflix,” Post and Schindler wrote. “While it is possible that there is some incremental churn from Disney+, it looks to be modest and we do not see any broad trend changes in our survey data compared to October.”

Still, Disney’s incursion into the streaming world represents one of the most strenuous tests yet for Netflix.

Analyst and investors alike have for weeks monitored streaming trends for any sign that Disney+’s trove of tried-and-true content like “Star Wars” and Marvel is either compelling enough to justify Americans’ use of both platforms or a substitution away from Netflix.

So even a marginal increase in the number of people saying they plan to cancel Netflix and stick with Disney could be a bad sign for the former.

To potentially make things tougher for Netflix, the competition shows little sign of easing as Amazon, Hulu and others compete for subscribers with original content and price warfare. While some have drilled down on big content spending and higher subscription fees, others have sought to offer more modest alternatives.