This post was originally published on this site

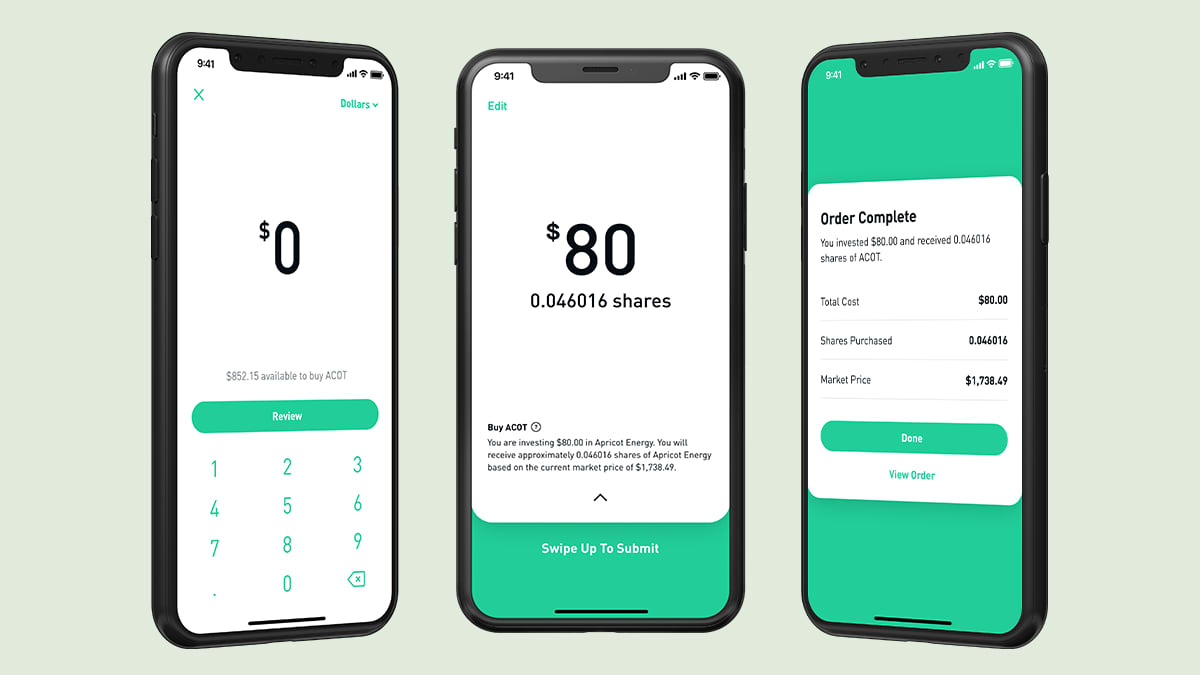

Robinhood fractional trading

Robinhood

Robinhood is getting in on the recent trend of companies letting traders buy a fraction of a share.

The start-up announced the launch of fractional stock-trading on its app Thursday as a way to lower the bar for investors. The feature allows users to popular tech names like Amazon — which trades in around $1,700 per share — for as low as $1.

Robinhood is the third company in the past few months to announce the feature, following Charles Schwab and Square’s lead. SoFi and Stash are among the fintech start-ups that also offer fractional trading. These companies all had the same rationale: bring trading to the masses.

“We have so many investors that just want to dip their feet into the market and put ten dollars in,” Robinhood CEO Vlad Tenev told CNBC in a phone interview. “We think this will empower even more people to invest.”

Square CEO Jack Dorsey, who also runs Twitter, said in October that fractional trading was a way to make “building wealth accessible to more people.” Charles Schwab was the first major brokerage firm to announce it would add the feature, and said it was about expanding access to younger clients.

The rise of fractional trading

The mutual fund industry has been handling fractional shares for years. But it’s relatively new for individual stock-trading.

The trend picked up with automated investing apps, known as “robo advisors,” such as Wealthfront, Betterment and Acorns, according to Robert Cortright, CEO of DriveWealth, which handles fractional trades for Square and other start-ups. Cortright said fintech companies needed a way to chop up and diversify someone’s $50 dollar investments the same way an ETF would on a larger scale. That strategy has only recently moved to individual trades, which Cortright said he expects to see more of in the future.

SoFi was among the first to launch a fractional feature in July said the demand to buy expensive stocks is now through the roof. Ownership of Amazon, for example, shot up 271% after they launched the feature. Seventy eight percent of SoFi Invest member’ first trades are fractional, according to the company.

There’s a “very strong relationship between high price to likelihood to buying fractional,” according to a SoFi spokesperson, who said the top five stocks on the app are now Amazon, Tesla, Apple, Disney, and Microsoft. Users are also more likely to buy in dollar amounts, instead of shares, according to the company.

Start-ups often use a third party to execute the trades and hold the remaining shares on their balance sheet. But Robinhood is doing this in house. The company plans to buy shares of whichever stock someone wants a piece of, divvy out the fraction, then keep the remainder in Robinhood’s portfolio. When enough people want to sell it and they have the equivalent of one share, Robinhood will sell it off their balance sheet.

That also means more market risk and exposure to volatility, which the Robinhood CEO said is “something they thought about” before launching.

“There’s definitely a small expense for us, but we learned through our research that customers really wanted this and we did a lot of work to manage that risk and be able to offer this product within our own systems,” Tenev said.

Moving past zero fees

Robinhood, last valued at $7.6 billion, said last week that it now has 10 million accounts, which Tenev called a “strong testament to demand.” But pressure is mounting to differentiate from other brokerage firms that have caught up on fees. The Menlo Park, California-based start-up gained popularity for commission-free trades in 2013. Major incumbents including Schwab, TD Ameritrade, E-Trade, and Interactive Brokers all slashed fees to zero in October.

“We see strong customer growth and retention, but we also understand that customers expect a high degree of service, especially from their financial institutions,” Tenev said. “We’re going to roll out more products and more services through 2020 and beyond.”

Robinhood also said that by early next year it will offer dividend re-investment plans, known as DRIPs, and the ability to schedule recurring investments and reinvest cash dividends back into the market.

The six-year-old company has raised more than $800 million from investors like NEA, Kleiner Perkins, and Sequoia. While Tenev would not comment on IPO plans or profitability, he said “the business is healthy and well capitalized.”