This post was originally published on this site

(This story is part of the Weekend Brief edition of the Evening Brief newsletter. To sign up for CNBC’s Evening Brief, click here.)

We’re now more than halfway through earnings season, but there are still a number of companies set to report quarterly results in the coming weeks.

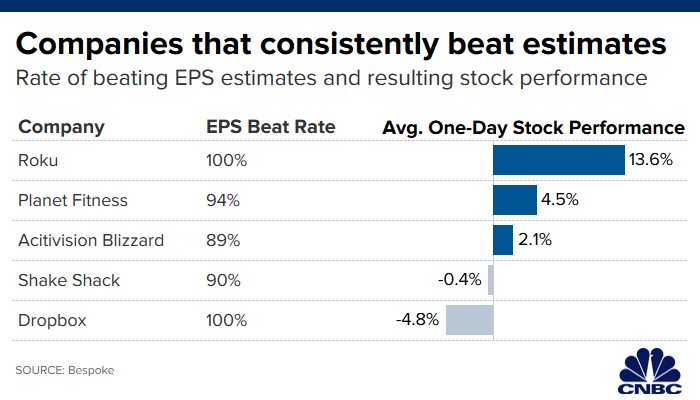

When it comes to names on deck for next week, CNBC crunched the numbers using data from Bespoke Investment Group and found five companies that almost always top the Street’s estimates.

Roku

Roku reports third quarter results on Wednesday after the market closes, and if history is any indication, there’s a good chance the company will beat expectations.

While the company is relatively young — it went public on September 29, 2017 — Bespoke found that Roku has topped estimates every single quarter. And the stock has been on a tear since the company went public. Shares priced at $14 ahead of the IPO, and the stock now trades at $145.

But the share surge has not been without volatility, and the stock has had a fair share of double-digit losses in a single session.

Key metrics for investors to watch in the quarterly report include ad revenue and active users. Competition from Amazon is heating up, but the company has also said it expects the launch of streaming services from Disney and CNBC-parent company NBCUniversal to help attractive users to the platform.

According to estimates from FactSet, analysts are expecting the company to lose 28 cents per share for the quarter, and report $256.7 million in revenue. This is a 48% increase from the $173.4 million that the company reported in revenue a year ago. That said, the 28-cent loss is wider than the 9-cent loss the company reported a year earlier.

Dropbox

Cloud company Dropbox reports third quarter results on Thursday after the market closes. According to Bespoke, it also beats estimates 100% of the time.

The company may be consistently delivering on quarterly results, but the stock has struggled to keep up. Since the company’s March 22, 2018 IPO, shares are down 29%. This could in part be due to investors shifting away from high-growth momentum names, favoring names with proven profitability instead.

This quarter analysts are expecting the company to report earnings of 11 cents, and $423.5 million in revenue, according to estimates from FactSet.

In October Nomura upgraded the stock to a buy rating, saying that the company could be about to report an uptick in revenue after multiple quarters of deceleration.

“We believe we are nearing an inflection in revenue after six quarters of deceleration as a public company,” Nomura analyst Christopher Eberle said in his October 22 upgrade. He also noted the company’s attractive valuation, industry-leading free cash flow, and margins of “mid-to-high 20s.”

He has a $25 price target on the stock, which is 24% higher than where the stock currently trades. His EPS estimate of 11 cents for the quarter is in-line with consensus, while his $434.5 million target for revenue is above the Street.

Planet Fitness

Bespoke found that gym operator Planet Fitness tops earnings estimates 94% of the time. The company reports third quarter results on Thursday after the market closes, and analysts are expecting EPS of 35 cents and $161.8 million in revenue, according to estimates from FactSet.

The stock climbed steadily higher for much of the year, but has since entered a bear market after coming under pressure since the June all-time high. The stock is also now trading below its 200-day moving average, which is a widely-followed technical indicator used to help determine a stock’s overall trend.

Guggenheim reiterated its buy rating on the stock ahead of upcoming earnings, saying that despite the recent pullback the company’s fundamentals remain strong, and shares trade at an attractive valuation.

“The company’s unique ability to produce 15-20% secular EBITDA growth while still generating $100-200 million of annual free cash flow over the next three to five years, by our estimates, merits a premium valuation to its growth-oriented peer group,” Guggenheim analyst John Heinbockel said in the October 28 note. He has an $85 target on the stock, implies a 34% upside ahead. He’s expecting the company to earn 34 cents for the quarter.

Shake Shack

The restaurant chain reports earnings on Monday after the close, and Bespoke found that it beats estimates 90% of the time. Analysts are looking for Shake Shack to report 21 cents in earnings, and $157.8 million in revenue, according to estimates from FactSet.

But some think that may be too optimistic.

Wedbush is expecting the company to earn 18 cents on $152.6 million in revenue. Analyst Nick Setyan has a neutral rating and $84 target on the stock. He believes cannibalization could be a potential headwind in coming quarters, and he also thinks that same-store sales growth guidance could be conservative.

Shake Shack shares have surged this year, gaining 81% compared to the S&P’s 22% return.

Activision Blizzard

Activision Blizzard earnings are on deck Thursday after the market closes. According to Bespoke, the company tops estimates 89% of the time.

On Friday at BlizzCon, the company’s annual gaming convention, ActivisionBlizzard announced the upcoming launch of Diablo 4, as well as Overwatch 2 and a World of Warcraft expansion which are all key franchises. This follows the October 25 launch of “Call of duty: Modern Warfare” which was positively received, grossing more than $600 million worldwide in its first weekend.

Estimates compiled by FactSet show that analysts are looking for 23 cents in earnings and $1.16 billion in revenue.

Stifel is expecting the company to report declining revenue, but the firm has a buy rating on the stock because it believes there are positive catalysts on the horizon.

“Our positive stance on the shares of Activision Blizzard is based on expectations for improving fundamentals beginning in ’20 and continuing forward, which we believe the shares will discount in advance,” Stifel analyst Drew Crum wrote in an October 23 note to clients. He is expecting the company to report EPS of 31 cents on $1.91 billion in revenue.

The video game maker has been caught in political crossfire recently. There were calls to boycott BlizzCon after the company took action against a player who showed support for the Hong Kong protesters.

Activision Blizzard and competitor Electronic Arts have both gained 21% this year.

Of course, topping quarterly estimates isn’t necessarily indicative of a company’s health. Sometimes companies purposefully lower estimates — called sandbagging — so that they are virtually guaranteed to beat estimates.

– CNBC’s Annie Pei contributed to this report.