This post was originally published on this site

Sunrun installer putting up solar electric panels on a residential rooftop in California.

Source: Sunrun

Hedge fund Tiger Global Management is making a big bet on continued expansion at San-Francisco-based Sunrun, which has grown into the nation’s largest residential solar company.

The fund, headed by Julian Robertson protégé Chase Coleman, has been steadily increasing its position in Sunrun since at least the first quarter of 2018. The firm now owns 29.7 million shares, or more than 25% of Sunrun’s equity, according to recent filings with the Securities and Exchange Commission.

Coleman was one of the so-called “tiger cubs” who started his investing career at Tiger Management under legendary investor Julian Robertson. Robertson closed the fund in 2000, after 20 years of heading it, at which point he gave Coleman $25 million to start his own fund, and Tiger Global was born.

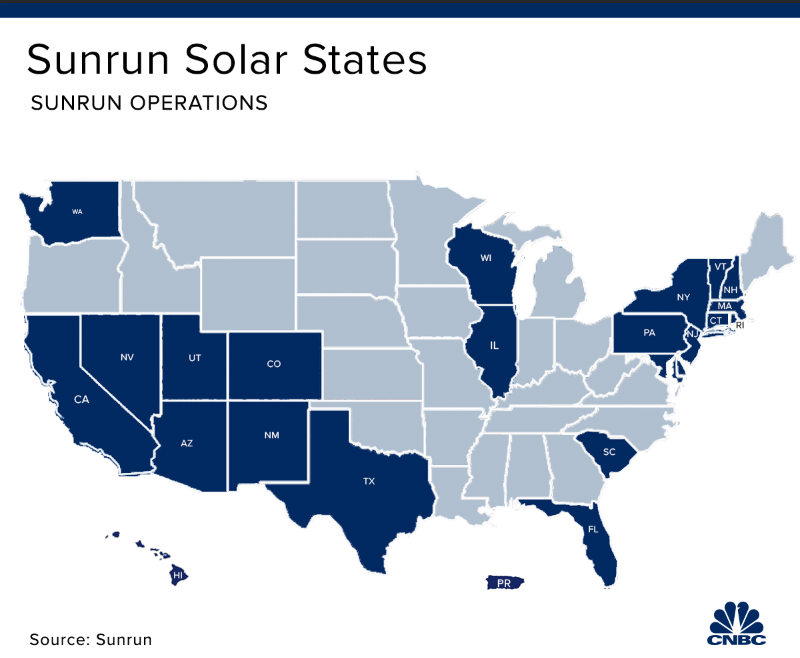

Since going public in August of 2015, Sunrun has been heavily focused on growth. With operations in 22 states as well as Washington DC and Puerto Rico, the company deploys a lease-focused business model that emphasizes positive cash flow generation over the long term.

Growth investor

Coleman is known for making successful bets on tech giants such as Facebook. The fund’s current top holdings, as of its latest filings, also include Microsoft, JD.com, Amazon, Peloton, Alibaba and Netflix.

The hedge fund isn’t alone in recognizing Sunrun’s trajectory. Venture Capital firms Sequoia Capital and Millennium also have positions in the company. Wall Street analysts have taken note as well.

“We believe RUN has significant growth potential and a differentiated and efficient financing strategy that position the company to benefit from what we believe could be a robust North American residential solar installation market through 2019,” Oppenheimer’s Colin Rusch wrote in a recent note to clients.

“What matters is RUN’s ability to put systems in the field and generate cash from the exercise. On this front, RUN is succeeding,” wrote JMP’s Joseph Osha.

When initiating coverage on the residential solar space in August, KeyBanc’s Sophie Karp argued that Sunrun offers “the best growth prospects” within an industry where market penetration is “barely scratching the surface.”

“Residential solar companies enjoy a constructive regulatory framework, a large total addressable market with low market penetration, and a favorable cost equation,” she wrote. She currently has an overweight rating and $19 dollar target on the stock.

Residential adoption of solar panels is expected to grow 8% year-over-year, according to research firm Wood Mackenzie, and investors are rewarding Sunrun for its growing share of the market. Since the third quarter of 2015, Sunrun has gained market share in all but two quarters.

Buying opportunity?

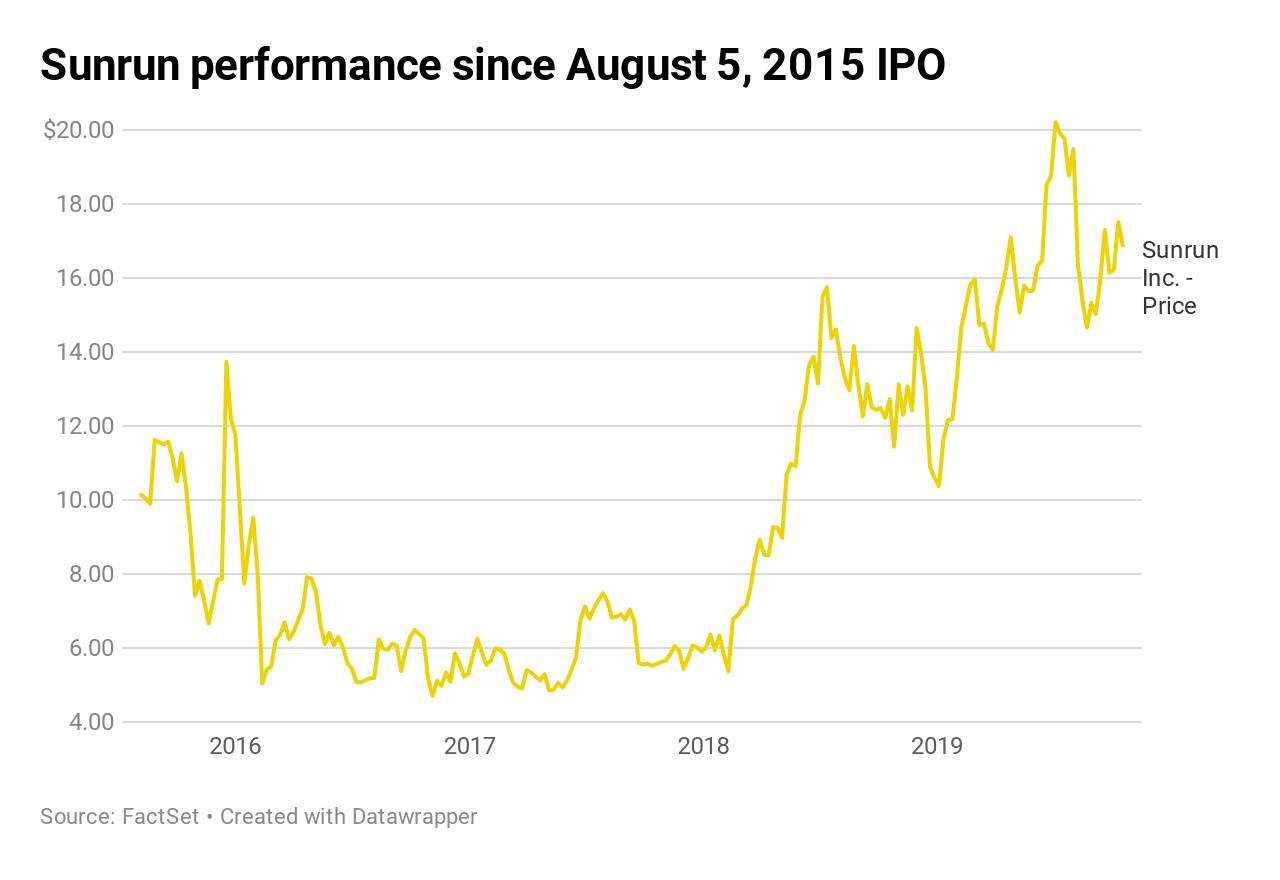

The stock is up 53% this year after soaring 85% in 2018. In the second quarter, the company announced that it had 255,000 customers, which represented 26% year-over-year growth, and the company emphasized that it is “cash flow positive while accumulating future cash flows.”

The stock, however, did sell off after second quarter results were announced due to light guidance and a tight labor market. So while shares have surged this year, the stock is currently in a bear market after sliding 20% from the July all-time high level.

Roth Capital Partner’s Philip Shen said the pullback presented a buying opportunity since the company’s underlying fundamentals remain intact and the labor issue in particular was a short-term headwind.

“We would accumulate shares on weakness as the fundamental demand is strong, and over time the labor issue, in our view, will be solved. Looking ahead, we believe new strategic partnerships continue to brew, and we see potential for more grid services announcements as well,” he wrote in an August note to clients.

While Wall Street’s sell side analysts are bullish on the stock, the company’s business model does make it somewhat challenging to value correctly.

Unusual model

When a homeowner signs up with Sunrun, it’s typically through a lease or a power purchase agreement. In a lease, the homeowner pays a fixed amount directly to Sunrun per month for electricity, while a PPA is based on a fixed rate per kilowatt hour. The amount charged increases at a fixed percentage per year, and the agreements are typically for 20 to 25 years.

The company handles the installation and financing costs, so there’s a big outlay of capital at the outset. But it’s offset, in theory, by the recurring revenue streams that the leases offer. Though less common, it’s also possible to buy the panels from the company outright.

“Due to the specifics of residential solar financing structures and complex accounting treatments, valuing residential solar on traditionally defined metrics appears impractical, and industry-specific metrics tend to obfuscate the impact of business model differences among peers,” Karp wrote.

She added that “FCF (free cashflow) generation is the most relevant metric … and customer value is the most accurate predictor of cash flows and the quality of the underlying business.”

JMP’s Osha currently has a market outperform rating and $26 target on Sunrun. When discussing his expectations for the company’s cash generation he noted that traditional valuation metrics look a little bit different when it comes to solar stocks.

“As always we remind investors that this number is not the same as the traditional definition of free cash flow yield, which does not work for RUN given the way the company’s business flows through its cash flow statement,” he said in a September note to clients.

.1571146467161.png)

Solar power is unquestionably gaining traction — for both individuals and companies — as a greater emphasis is placed on renewable energy sources more broadly. California announced earlier this year, for example, that starting in 2020 new houses constructed, with a few exceptions, will have to include solar panels.

That said, the sector has traditionally been a highly volatile one. Policy changes and geopolitical tensions can have a big impact on a company’s bottom line. For instance, solar panel imports are currently taxed as part of President Donald Trump’s tariff charges, and a tax credit that allowed people to deduct 30% of the cost of installing a solar energy system is set to be reduced at the end of the year. Next year, the rate will drop to 26%, followed by 22% in 2021 and 10% in 2022. Some of this uncertainty is perhaps reflected in Sunrun’s short interest, which at 16.3% of float, is relatively high.

The company also has not been without controversy. Some employees said they were encouraged to misreport key data ahead of the company’s 2015 IPO, and consumers have filed complaints with the FTC saying they were misled by sales representatives. Some have also pointed out that solar panels can make selling a house more challenging since the new owner has to agree to take over the solar lease, or else buy the panels from the company outright.

The company’s next frontier is power storage. In addition to installing solar panels, the company also offers Brightbox, which is a home battery storage system that captures and stores energy for use at a later time, such as at night.

Last week, when PG&E announced preemptive power cuts for more than 700,000 customers as a way to curb the outbreak of wildfires, Sunrun touted the usefulness of its battery storage system, tweeting that it allows customers to “take back control of” their homes.

As the country shifts away from fossil fuels, Sunrun is hoping that its power storage will become a part of “virtual power plants.”

“Sunrun is positioned to win with our Brightbox offering, targeted customer acquisition capabilities,” Sunrun CEO Michelle Jurich said on the company’s second quarter earnings conference call. “What we’re going to be able to do is offer our customers all the benefits of the solar plus storage, which is cleaner, cheaper energy, plus backup power, but we’re also, as being part of our virtual power plants, going to be able to monetize that battery for additional value.”

Tiger’s Coleman did not return a call for comment on his position.

– CNBC’s parent company Comcast has a partnership with Sunrun.